6214(a) generally gives the Tax Court jurisdiction to redetermine the correct amount of a taxpayer's deficiency. The IRS countered that it was valid because it was sent to their last known address and that therefore the taxpayers had not timely filed their Tax Court petition. The couple claimed that the notice was invalid because it was not sent to their last known address. 17, 2017, and they filed a petition with the Tax Court contesting the IRS's determination that same day. The Gregorys became aware of the notice of deficiency on Jan.

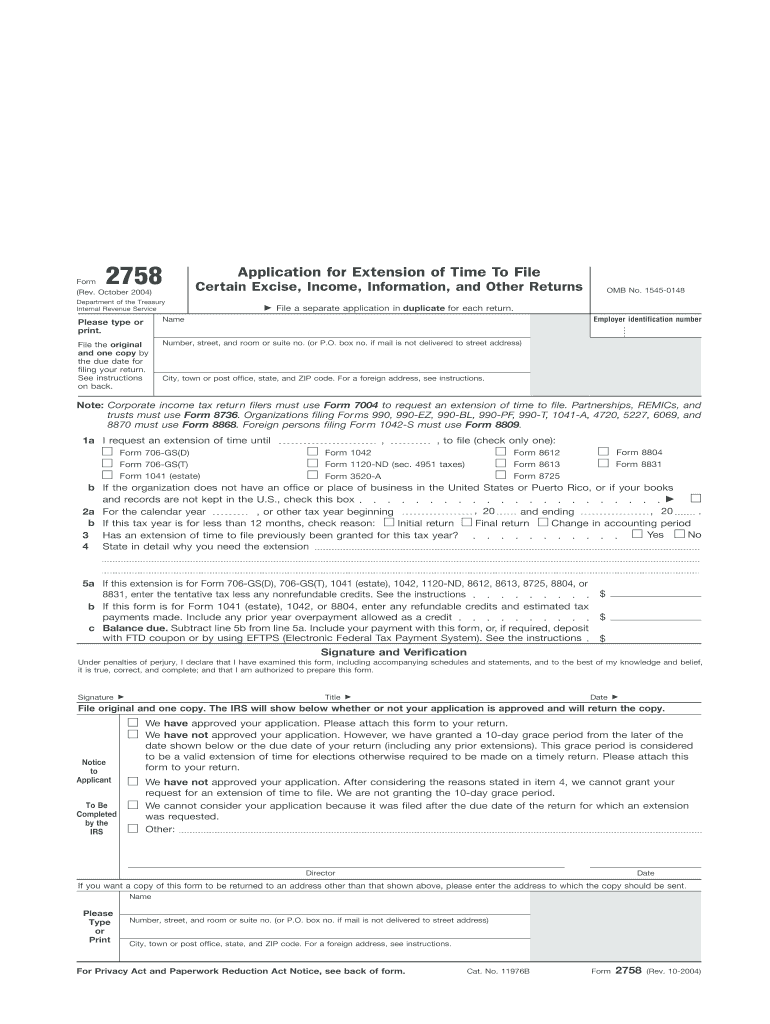

The Gregorys and the IRS agreed that the couple did not actually receive the notice of deficiency. Postal Service marked the notice "Return To Sender/Unclaimed/Unable to Forward" and returned it to the IRS. At that time, the Gregorys had not yet filed their 2015 federal income tax return. 13, 2016, the IRS sent a notice of deficiency to the Gregorys at their Jersey City address. In April 2016, they used the Rutherford address again when they submitted a Form 4868, Application for Automatic Extension of Time to File U.S. The Gregorys first used the Rutherford address in correspondence with the IRS when they submitted Forms 2848, Power of Attorney and Declaration of Representative, in November 2015. 15, 2015, they incorrectly used their old Jersey City address. But when they filed their 2014 federal income tax return on Oct. Backgroundĭamian and Shayla Gregory moved from Jersey City, N.J., to Rutherford, N.J., on June 30, 2015. For change- of- address purposes, the forms did not constitute "returns" and they did not provide "clear and concise notification" to the IRS of the taxpayers' new address. The Tax Court held that the taxpayers' submission of a power of attorney form and an extension for filing their income tax return did not update their last known address with the IRS.

0 kommentar(er)

0 kommentar(er)